Our Pallet Price Trends for 2024 marks the third pallet price trends annual report from FALM, following our 2022 and 2023 reports.

Prices have continued to soften since the pallet market startled supply chains with its historically unparalleled wild gallop in January 2021. Supply chain decision-makers frantically clenched the reins for several months as pricing reached an apex in April 2022. It was a time associated with pallet shortages, and anxiety was palpable as customers braced for supply shortfalls. The FRED Index (see reference below) increased by 51.7% during that period. In many cases, price increases were even more dramatic. Between April 2021 and April 2022, #1 recycled pallet prices in California increased over 100% from $9.15 to $18.75 (Recycled Record data).

After April 2022, however, pricing has been trending downward. As discussed below, however, we may have reached the bottom of the cycle, and many industry participants are optimistic of a modest recovery.

Pallet Prices

Pallet buyer memories can be short, and behavior has reverted only a few years after the historic pallet shortage event. Softer markets have resulted in significant “price shopping” among vendors by pallet customers and more short-term procurement practices versus longer-term contractual commitments. Meanwhile, pallet producers struggling for sales have increasingly looked to non-asset-based partners such as FALM to help sell pallets in these demanding market conditions. Non-asset-based pallet providers are important in helping pallet companies move inventory, particularly during periods of soft demand.

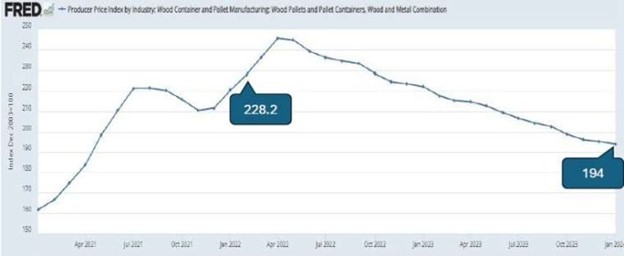

Pallet prices have continued to soften, albeit at a much lower rate, and seem to be bottoming, according to the Producer Price Index. The Producer Price Index (PPI) for Wood Container and Pallet Manufacturing is a measure published by the U.S. Department of Labor’s Bureau of Labor Statistics. This index tracks the average change over time in the selling prices received by domestic producers for their output in the wood container and pallet manufacturing industry.

PPI information shows that wood pallet prices dropped from an index level of 222.2 in January 2023 to 194 in January 2024, a decrease of 12.69% (See graph below). The rate of decrease has continued to flatten, falling another 2.27% between January and April 2024. The lumber market is improving, resulting in modestly higher lumber input prices for pallets. This will push pallet producers to pass along increases. Meanwhile, pallet demand is also starting to improve incrementally.

Hardwood Vs Softwood

In recent years, one interesting area of change has been the continued migration of customers from hardwood to softwood pallets, reflecting the better availability and pricing of softwood material. Back in 2016, researchers found that 45% of wood pallets in the US were made of hardwood while 55% were built from softwood. Unofficial figures for 2021, the latest numbers available, detailed a shocking change in the marketplace. In the course of just 5 years, the volume of hardwood lumber used for pallet construction plummeted to 19%, while the volume of softwood has soared to 81%.

New Vs Recycled

Shippers want to save as much money as they can. Majority of time, we are experiencing buyers are seeking recycled pallet more than new in 48×40, based on price point and also corporate green initiatives. so in general from a cost savings and also green initiatives. However, new pallets are requested by sensitive food and pharmaceutical customers.

Wood pallet prices

Wood pallet prices. Source: https://fred.stlouisfed.org/series/WPU08410101

Material Prices

Lumber

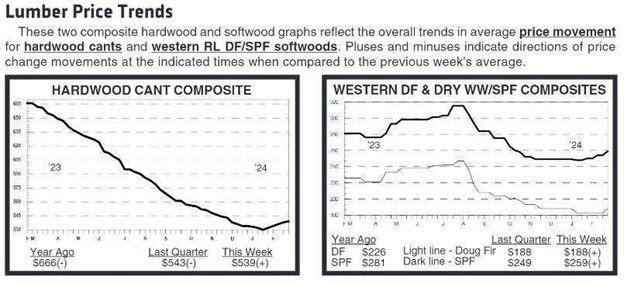

Lumber, the largest component of new pallet cost, has finally bottomed and is moving modestly upward (See Pallet Profile graphs below), aided in some regions by mill cutbacks. Variables such as weather conditions that impede logging, uncertainty about a CN rail strike in Canada, and summer forest fires will push lumber prices upward, ultimately leading to higher new pallet prices.

Hardwood has experienced a rough time in recent years. U.S. hardwood lumber exports have significantly declined, particularly to major markets like China and Europe. The reduction in export volumes is attributed to competitive pricing from alternative suppliers and trade policy impacts. The construction and housing sectors, major domestic consumers of hardwood lumber, have faced slowdowns, reducing their purchasing volumes. Allegheny Wood Products, a major hardwood sawmill operator in West Virginia, ceased operations in February 2024, impacting hundreds of workers and contractors across multiple locations in West Virginia. A lackluster market is generally bad news for hardwood pallet buyers. A robust industry supply of hardwood pallet stock hinges on mills producing grade material. As mentioned above, the hardwood share of the pallet market continues to decrease as more pallet buyers convert to softwood.

Lumber Price Trends. Source: Pallet Profile Weekly https://www.palletprofile.com/ (Paid subscription required)

Softwood lumber prices

Softwood lumber prices. Source: NRCAN: https://natural-resources.canada.ca/

Hardwood lumber prices

Hardwood lumber prices. Source: https://fred.stlouisfed.org/series/WPU0812#

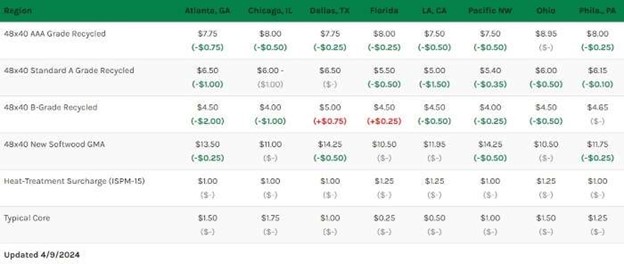

Pallet Cores

Like pallet availability and pricing, core availability has taken a roller coaster ride in recent years. At the height of the shortage, pallet users were holding onto pallets that otherwise would have been released back to recyclers. As supply chains burned through heavy “just in case” inventories in 2022 and 2023, pallet cores flooded the market. Pallet yards nationwide were full, and recyclers have become increasingly strategic about accepting cores.

The pallet core is the basic ingredient for the recycled pallet supply. Reparable cores are refurbished, and badly damaged or off-size pallets are dismantled to harvest usable components. Current typical prices for cores range from $0.25 in Florida to $1.75 in Chicago. (See graph below.)

Labor Challenges Remain

While the higher wages paid to laborers have propelled some new pallet providers to implement automation into their operations, conversion takes time and is far from universal, particularly for recyclers. The pallet industry, particularly pallet recycling, remains highly labor-intensive. Unlike wood prices, which have sagged since the 2022 peak, wage gains have largely stuck. Better labor availability, however, has allowed operations to cut back on overtime.

An article published by Pallet Enterprise through the 2023 Human Resources & Wage survey for the pallet industry found the following:

“The mean average beginning laborer wage increased from $9.98 in 2016 to $15.42 in 2022/2023. That represents a 54.51% increase since 2016. Other positions have seen even higher rate increases. And while lumber and cores prices have dropped dramatically, the same can’t be said for wages.”

Source: https://palletenterprise.com/

The Recycle Record has also published the following on the current pallet labor market:

The higher wages that are required to retain employees in the pallet industry become very prevalent. On top of higher wages being paid, other external factors such as labor shortages and competition continue to be an issue to retain employees. The factors we presented in our previous justification remain present today.

- Increased wage competition from similar low skilled industries (construction, manufacturing, and warehousing)

- Shortage of unskilled labor

Source: http://palletprofile.com/pallet/index.asp

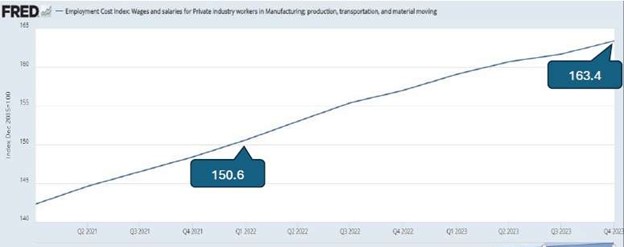

Employment Cost Index

The Employment Cost Index (ECI), published by the U.S. Department of Labor’s Bureau of Labor Statistics (BLS), is a quarterly economic series that measures the changes in labor costs, free from the influence of employment shifts among occupations and industries. The ECI tracks the total compensation costs, including wages, salaries, and employer costs for employee benefits for civilian workers and specific segments such as private industry and state and local government workers.

As a counterpoint to falling material costs, ECI continues to rise. ECI data below shows a rise from 150.6 in Q1 of 2022 to 163.4 in Q4 of 2023, an 8.5% increase during this period.

- 2022 Q1: 150.6

- 2022 Q4: 157.0

- 2023Q4: 163.4

ECI is critically important to business owners at large as it helps them manage and plan for labor costs effectively. By tracking changes in wages, salaries, and benefits, the ECI provides a comprehensive view of labor cost trends, allowing businesses to budget accurately for future expenses. This data is essential for setting competitive salaries, ensuring that companies can attract and retain talent without overspending. Additionally, businesses engaged in union negotiations or collective bargaining agreements rely on the ECI to justify wage adjustments and benefits costs, making it a vital tool for maintaining fair compensation practices.

Moreover, the ECI aids business owners in developing pricing strategies for their products and services. Understanding these trends helps businesses adjust their pricing to maintain profitability as labor costs influence overall expenses.

Wages and salaries

Employment Cost Index. Source: https://fred.stlouisfed.org/series/CIU2023000500000I

Transportation

Transportation plays an important role in the pallet industry, both for inbound lumber and nail deliveries and outbound pallet delivery. Pallets, when assembled, do not have a high-value density. As such, they have been uneconomical to ship across considerable distances. The rule of thumb has been generally around 200 miles or less. Regional disparity in pallet pricing and better freight availability can help some pallet suppliers ship competitively to more distant markets.

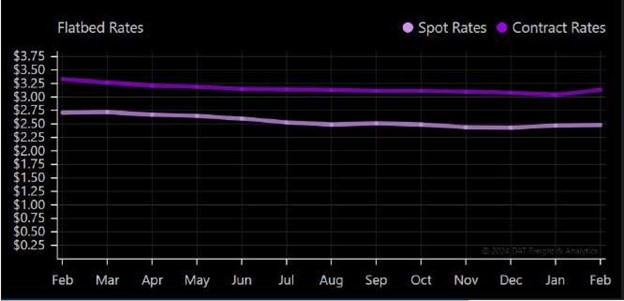

National Per Mile Flatbed Rates

The rate of $2.71 per mile in February 2023 fell to $2.48 in February 2024, corresponding to an 8.5% decrease in per mile flatbed rates.

These rates are essential for longer-haul carriers; however, they are less relevant for pallet deliveries. We mainly book half-day or full-day rates to flatbed carriers, depending on the length of the haul. These “local” rates have not seen the same decline as the per-mile long haul rate. Flatbed rates will also begin to increase as demand for this equipment comes back in the spring and summer months.

- February 2023: $2.71 per mile

- February 2024: $2.48 per mile

Flatbed rates. Source: https://www.dat.com/trendlines/flatbed/national-rates

Load-to-Truck Ratio

The DAT Load-to-Truck Ratio is a critical metric in the freight transportation industry, indicating the balance between freight loads and available trucks. It represents the number of loads posted on DAT load boards per available truck and serves as a barometer for supply and demand in the trucking market. A high load-to-truck ratio suggests a tighter capacity, leading to increased freight rates and potential delays in securing transport. Conversely, a low ratio indicates a surplus of available trucks, which can drive down transportation costs and improve service reliability.

Remember that the pallet market is strongly tied to the transportation market. According to Chaille Brindley of Industrial Reporting, the pallet market lags transportation but ultimately follows its lead.

The flatbed load-to-truck ratio remained low in 2023. The ratio has shown upward movement in 2024, however, increasing from a rate of 13.31 in January 2024 to 18.51 in April, the highest level since July 2022, another indication of a recovering transportation market.

Flatbed Load-to-Truck Ratio

Flatbed Load-to-Truck https://www.dat.com/trendlines/flatbed/demand-and-capacity

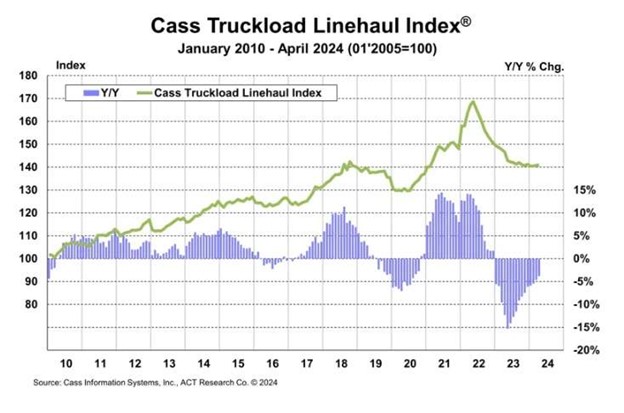

CASS Linehaul Index-The Cass Truckload Linehaul Index® is a measure of market fluctuations in truckload linehaul rates in the U.S. It tracks changes in per-mile truckload costs, excluding fuel and accessory charges, providing a clear picture of pure freight rate movements. This index provides crucial insights into pricing trends and market conditions. By monitoring the index, businesses can make informed decisions regarding budget planning, contract negotiations, and overall logistics strategies, helping them manage costs more effectively and anticipate market shifts.

The Cass Linehaul Index is starting to level out around the 140 mark through April 2024, after general declines subsequent to the mid-2022 peak.

Below are the CASS values in January over the last three years.

- Jan-2022 – 158.00

- Jan-2023 – 149.23

- Jan-2024 – 140.40

CASS Linehaul Index

Source: https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/truckload-linehaul-index

Fuel

Over the past few years, diesel prices in the United States have experienced significant fluctuations due to various factors, including supply chain disruptions, geopolitical events, and changes in demand. As of May 2024, the average U.S. on-highway diesel fuel price is around $3.79 per gallon, reflecting a decrease from earlier highs in 2022 and 2023. This decrease is attributed to increased refinery capacity and improved inventory levels, which have helped stabilize the market.

According to the U.S. Energy Information Administration (EIA), diesel prices are expected to continue their downward trend through 2024 and into 2025. This forecast is based on several supply-side factors, including higher refinery outputs and strategic releases from oil reserves by the U.S. government and other International Energy Agency (IEA) member countries. These measures are aimed at counterbalancing any potential disruptions in oil supply, particularly from geopolitical tensions affecting major oil-producing regions like Russia.

Source: https://www.eia.gov/petroleum/gasdiesel/

Navigating the Pallet Price Trends

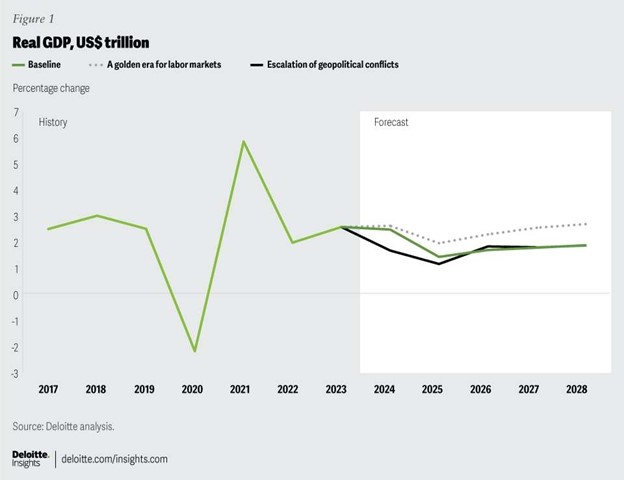

Big picture, Deloitte’s outlook on the U.S. economy is surprisingly positive despite prevailing concerns over high interest rates, inflation, and potential economic slowdown. The firm suggests that the economy may be on track for a “soft landing,” where inflation is controlled without triggering a recession. This optimism is driven by strong job markets, robust consumer spending, and rising exports. The baseline forecast predicts continued economic strength, with GDP growth of 2.4% in 2024 and 1.4% in 2025, supported by consumer spending, investment, and government expenditure, alongside a modest reduction in inflation.

However, Deloitte also highlights several downside risks, particularly geopolitical tensions in Europe and the Middle East, which could disrupt trade and economic stability. These conflicts can potentially increase commodity prices, notably oil, which could keep inflation elevated. An alternative scenario considers the possibility of significant geopolitical escalation, which would slow economic growth to an average of 1.6% annually from 2024 to 2028. Additionally, a more optimistic scenario envisions a “golden era” for labor markets, driven by technological advancements and increased labor force participation, potentially boosting GDP growth to 2.4% annually over the same period.

The outlook for pallet prices in 2024 indicates that the significant price declines observed in 2023 have stabilized, suggesting that the market may have reached its bottom. While the market shows signs of recovery, wild card events, such as extreme weather, wildfires and geopolitical tensions, could influence the pallet market and pallet prices in the near term. However, the overall sentiment in the industry is cautiously optimistic, with expectations of moderate price increases driven by improving market conditions.

As always, navigating the pallet price trends remains challenging. Contact First Alliance Logistics Management to find out how we can help you better plan your pallet strategy for the months and years ahead.